Page 9 - 2003-2004

P. 9

ship, an Armenian citizen permanently residing outside of Armenia, or an inter-

national organization that invests in Armenia. “Foreign investment” is any form

of property, including financial assets and intellectual property, which is

invested by a foreign investor directly in the territory of Armenia, in any

economic or other venture.

INVESTMENT INCENTIVES

ACCESS TO CIS AND MIDDLE EAST MARKETS

NO EXPORT DUTY

FOREIGN EXCHANGE FREE CONVERSION

FREE REPATRIATION OF PROFIT

POLITICAL AND ECONOMIC STABILITY

FAVORABLE INVESTMENT LEGISLATION

INVESTMENT GUARANTEES

STRONG GOVERNMENT COMMITMENT TO ATTRACT FDIS

WELL EDUCATED, SKILLED AND EASILY TRAINABLE WORKFORCE

COST-EFFICIENT LABOR FORCE AND SCIENCE BASED SKILLS

NO RESTRICTIONS ON STAFF RECRUITMENT

CORPORATE TAX HOLIDAYS AVAILABLE FOR COMPANIES WITH 500 MILLION AMD FOREIGN

INVESTMENTS

PROFIT TAX EXEMPTIONS FOR COMPANIES IN AGRIBUSINESS

100 PER CENT OWNERSHIP BY FOREIGNERS PERMITTED

NO RESTRICTIONS ON REMITTANCES

STABLE LOCAL CURRENCY

COMPETITIVE ENERGY COST

Foreign investors can make investments in Armenia through establishment of fully

foreign-owned companies (including representations, affiliates, and branches),

purchase of existing companies and securities, or establishment of joint ven-

tures. The company registration process takes about a week.

Companies with foreign investments of over 500 million AMD (about 855,000 US$)

enjoy a corporate tax holiday for two years after making an investment (for

details see Taxation Section). In addition, there are a number of special tax

incentives in Gyumri Region.

There are also incentives for exporters - no export duty and VAT reimbursement on

goods and services exported.

There are no limitations on the volume and type of foreign ownership, number of

foreign employees and access to financial sources. Although foreigners can only

lease land, a company registered by a foreigner as an Armenian business entity

does have the right to buy land. Foreigners may obtain permission to use land

under long-term leases, and concessions for the use of Armenian natural resources

with the participation of an Armenian company.

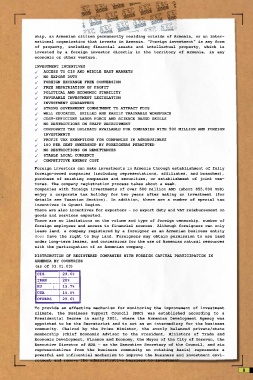

DISTRIBUTION OF REGISTERED COMPANIES WITH FOREIGN CAPITAL PARTICIPATION IN

ARMENIA BY COUNTRIES

(as of 01.01.03)

CIS 29.6%

IRAN 20%

EU 15.7%

USA 15.5%

OTHERS 29.6%

To provide an effective mechanism for monitoring the improvement of investment

climate, the Business Support Council (BSC) was established according to a

Presidential Decree in early 2001, where the Armenian Development Agency was

appointed to be the Secretariat and to act as an intermediary for the business

community. Chaired by the Prime Minister, the evenly balanced private/state

membership (Chief Economic Adviser to the President, Ministers of Trade and

Economic Development, Finance and Economy, the Mayor of the City of Yerevan, the

Executive Director of ADA - as the Executive Secretary of the Council, and six

representatives from the business community on rotating basis) represents a

powerful and influential mechanism to improve the business and investment envi-

ronment and remove the administrative barriers to investment.

9 9 9 9 9